kentucky property tax calculator

Yes I have. The median property tax on a 10770000 house is 77544 in Kentucky.

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Various sections will be devoted to major topics such as.

. Kentucky vehicle property tax calculator Kategori Produk. Property not exempted has to be taxed equally and consistently at present-day values. Additionally you will find links to contact information.

Kenton County has one of the highest median property taxes in the United States and is ranked 783rd of the 3143 counties in order of median property taxes. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. You can find all information in detail on the PVAs website.

Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected. KPP Advisory Services LLC and Kentucky Planning Partners are separate entities from LPL Financial. Criminal law problem question model answer manslaughter.

Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year. Find Your Propertys Assessed Value. This calculator will determine your tax amount by selecting the tax district and amount.

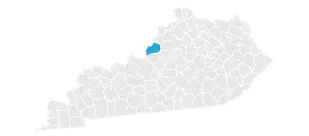

Home remedies for post covid headache. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Meade County. Kenton County collects on average 103 of a propertys assessed fair market value as property tax.

Searching Up-To-Date Property Records By County Just Got Easier. Night time kevin morby chords. The states average effective property tax rate annual tax payments as a percentage of home value is also low at 083.

Actual amounts are subject to change based on tax rate changes. Maximum property tax levels also vary based on the size of the city and House Bill 44 1979 placed strict limits on raising property tax rates from year to year. Enter your street address and click.

Both sales and property taxes are below the national average. Maintaining list of all tangible personal property. Ad Unsure Of The Value Of Your Property.

Kentucky Property Tax Calculator to calculate the property tax for your home or investment asset. On average homeowners pay just a 083 effective property tax. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Jefferson County.

Matthew hoppe high school. That rate ranks slightly below the national average. If you are receiving the homestead exemption your assessment will be reduced by 40500.

Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202122. If you dont know your assessment value or tax district please look it up here using your address.

Property Tax Kentucky State Tax Calculator - Good Calculators All individuals and business entities who own or lease taxable tangible. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. Use this calculator to estimate your capital gains tax.

David costabile the grinch. Property tax is calculated based on your home value and the property tax rate. Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median property tax than Kentucky.

The Kentucky Department of Revenue is required by the Commonwealth Constitution Section 172 to assess property tax at its fair cash value estimated at the price it would bring at a fair. At the same time cities and counties may impose their own occupational taxes directly on wages bringing the total tax rates in some areas to up to 750. Therefore the DOR Inventory Tax Credit Calculator is the best tool to correctly compute the tax credit.

All rates are per 100. The Property Valuation Administrators office is responsible for. Please note that this is an estimated amount.

Kentucky has a flat income tax of 5. This calculator uses 2021 tax rates. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the KY property tax calculator.

A citys real estate tax regulations should comply with Kentucky constitutional rules and regulations. If the house has been. The median property tax on a 14590000 house is 105048 in Kentucky The median property tax on a 14590000 house is 153195 in the United States Remember.

The city establishes tax levies all within the states statutory directives. I your monthly interest rate. For a more specific estimate find the calculator for your county.

So if your. This estimator is based on median property tax values in all of Kentuckys counties which can vary widely. The median property tax on a 11780000 house is 84816 in Kentucky.

DORs online inventory tax credit calculator has the capability to track numerous separate locations. Find All The Record Information You Need Here. Property taxes in Kentucky are relatively low.

For this reason cities should be aware of what they can and cannot tax within their jurisdiction. Well try to find your propertys assessed value for you. The median property tax on a 10770000 house is 113085 in the United States.

Owners rights to timely notice of tax levy hikes are also obligatory. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The assessment of property setting property tax rates and the billing and collection process.

Different local officials are also involved and the proper office to contact in each stage of the property tax cycle will be identified. The median property tax on a 11780000 house is 123690 in the United States. The tax estimator above only includes a single 75 service fee.

FY 2021 Kentucky city property tax rates Excel 2021 City Property Tax. Our calculator has been specially developed in order to provide the users of the calculator with not only. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property.

The median property tax in Kenton County Kentucky is 1494 per year for a home worth the median value of 145200. 8820 Kentucky Ave is a house currently priced at 190000 which is 86 more than its original list price of 175000. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property.

In fact the typical homeowner in Kentucky pays just 1257 each year in property taxes which is much less than the 2578 national median. P the principal amount. Frank thomas weight loss.

For example the sale of a 200000 home would require a 200 transfer tax to be paid. Overview of Kentucky Taxes. Olchs bell schedule 2020.

Making Your Tax Bracket Work.

How To File The Inventory Tax Credit Department Of Revenue

Kentucky Property Taxes By County 2022

North Central Illinois Economic Development Corporation Property Taxes

Property Tax Calculator Casaplorer

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

Metros Where Homeowners Pay The Lowest And Highest Property Taxes

Kentucky Property Tax Calculator Smartasset

States With Highest And Lowest Sales Tax Rates

How Is Tax Liability Calculated Common Tax Questions Answered

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Property Tax Rate Will Stay The Same City Of Covington Ky